Discover the Benefits of Membership

When you bank with Texell Credit Union, you’re not a customer; you’re a member. And the benefits of membership are many.

In Addition to Trusted, Personalized Service, You’ll Love:

- Earning BONUS Rewards Points on your debit card!

- Early payday with direct deposits to your checking account1

- Access to 92,000+ free ATMs worldwide

- The best rates2 on loans, credit cards, and certificates

You’ll Also Love…

- Personalized consideration on loan applications, even when national banks say “no.”

- Deposit account balances insured for up to $500,000.3

- Trustworthiness and exceptional service, dating back to our founding in 1948.

- All the features of larger banks with the service of a neighborhood institution that excels at service.

Ready to switch to something better? Open your account online now; it only takes 4 minutes!

1 With Early Payday, Texell may make incoming ACH direct deposit funds available to you up to 2 days before the scheduled payment date. The early availability of direct deposits depends on the timing of submission by the payor and is not guaranteed. Some direct deposit types may be ineligible for early access at Texell’s discretion. Early availability may be impacted by fraud prevention screening, and Texell may set limits on the amount of funds that may be made available to you early.

2 Loans and Credit Cards subject to credit approval.

3 Your deposits are federally insured for $250,000 and backed by the full faith and credit of the National Credit Union Administration, a U.S. Government agency. Your deposits are insured for an additional $250,000 through private insurance provided by Excess Share Insurance Corp.

Open your account in 4 minutes

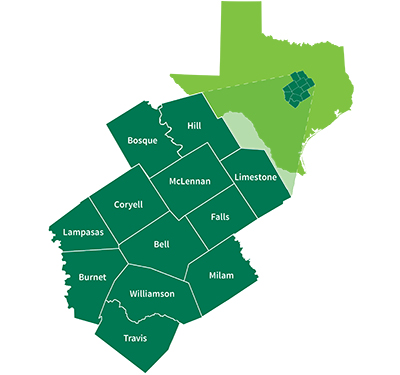

Who's Eligible to Join Texell?

Texell Makes Texas a Better Place

You live in Texas, so why not bank with a credit union committed to your community? When Texell Serves, we don’t just write a check. We get hands-on. Learn more about the good work we do through Texell Serves.